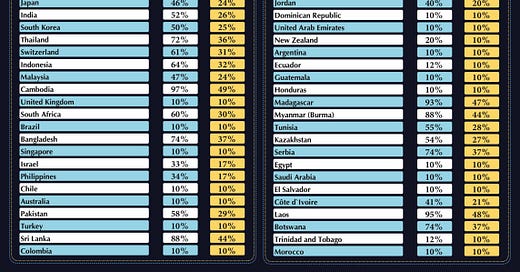

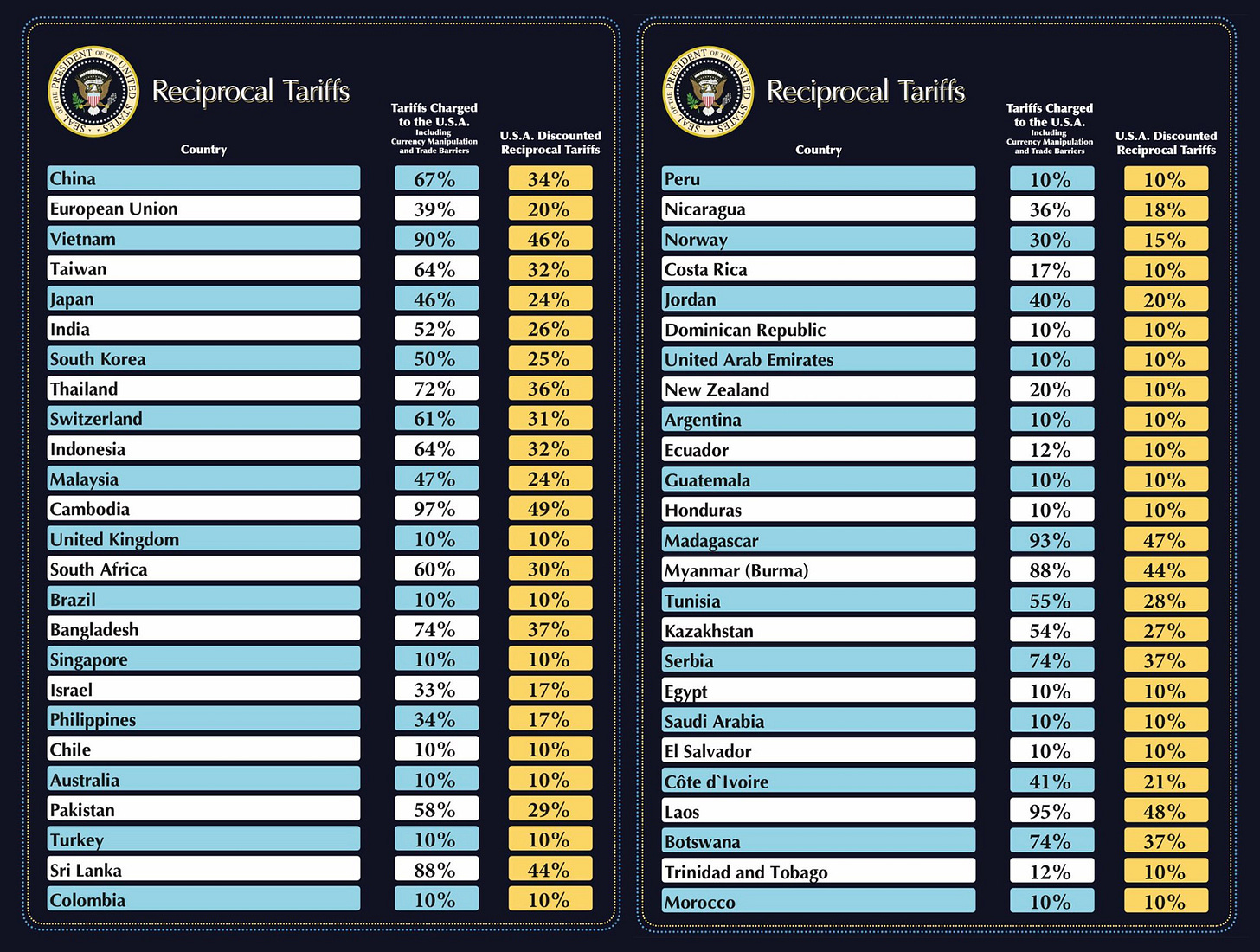

A few days after writing about anticipated Trump tariffs, we got the official announcement yesterday afternoon. Here is the top of the list.

Leftists were melting down that the list wasn’t in alphabetical order. It is listed in descending order of trade volume, with the largest trade relationships (other than Canada and Mexico) at the top.

The formula for American tariffs is quite puzzling. It appears to be half the rate of tariffs charged by the other country, but never less than 10%. Here is a graph of that relationship. The horizontal axis represents the other country’s tariff rate on American goods. The vertical axis represents the American tariff rate on the other country.

The black line represents a true reciprocal tariff. The red line is our actual policy. Sadly, it means that allies that charge no tariffs at all, like Israel, are still charged a 10% tariff. Thus other countries have an incentive to raise their tariffs to 10% because they have nothing to lose.

But wait, it gets trickier. The foreign tariff rates quoted by the administration are not the true official tariff rates. They represent the trade deficit run by America with the other country, divided by either exports or imports, depending who you ask.

The underlying assumption is that America should have no trade deficit with any country. This assumption is connected to the American school of economics, the American system, and mercantilism, all of which appeared to serve this country well prior to the adoption of “classical” economics, one of the most corrosive philosophies in American history.

This would all be an abstract discussion if it weren’t for the collapse today on Wall Street. Take heart, dear reader. It could get a lot worse, and maybe will get a lot worse. However, as many have observed, Wall Street is not Main Street. Finance is not the economy.

There will be pain in the short term. I see that when I shop for avocados. Various factors may reduce the overall pain.

We saw in the first Trump administration that foreign exporters to America reduced their prices to maintain market share, and the American government received revenue as a result.

Foreign investors have already committed $4 trillion to new business development in America.

American businesses are reversing their earlier decisions about offshoring jobs.

If Congress can get federal spending under control, DOGE can identify $1 trillion of waste-fraud-abuse, and Trump can raise enough tariff revenue, we may be able to start paying off some of our crippling $36 trillion debt, more than the $30 trillion gross domestic product of this country. It is my hope that Americans will start going back to work and stop sending our jobs overseas at the behest of politicians and professors.

Your investment account may take years to recover, however, especially if you are 100% in stocks. I am not a financial advisor, but I have used my data skills to study the behavior of financial markets. My study suggests that portfolios anywhere from conservative to moderate can all benefit from the presence of stocks, bonds, and gold, all three. Caveat emptor: let the buyer beware!

The question for national debt is “who do you, and us in the UK, owe the money to?”