Benjamin Franklin instructed us that “Early to bed and early to rise / Makes a man healthy, wealthy, and wise”. Health and wealth are both desired by most people. The reason can be found in the etymologies of these words. Health is related to heal and whole; wealth is related to well. These days, wellness is considered a synonym for health.

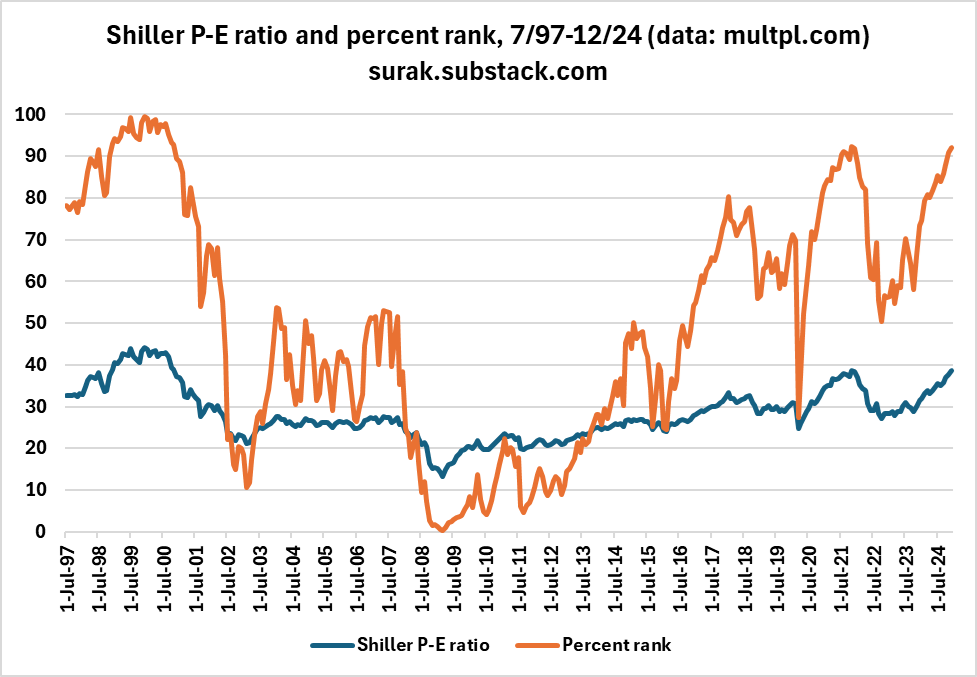

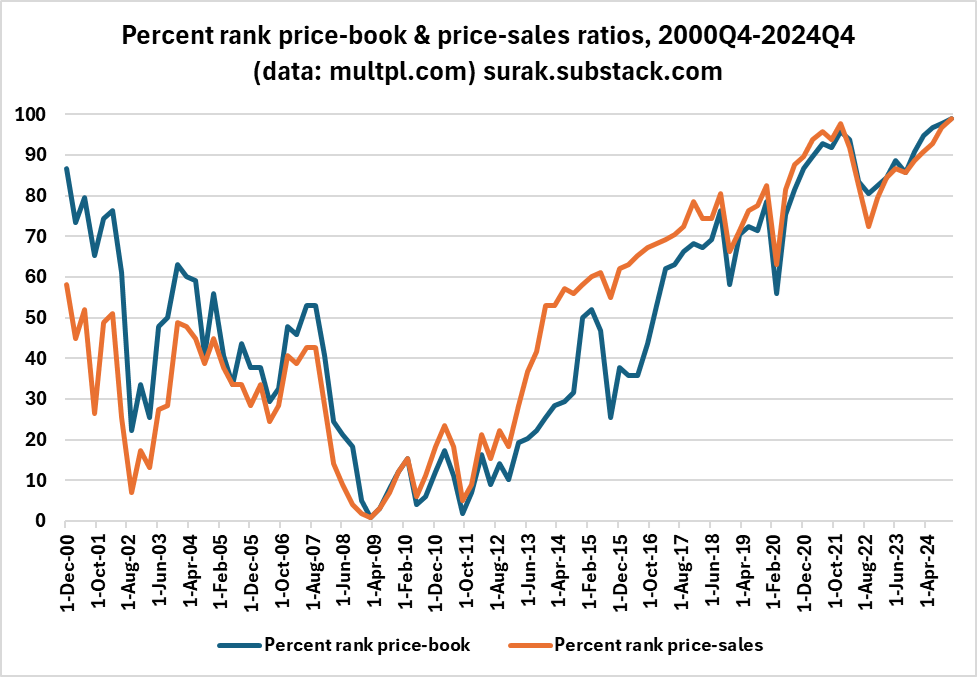

The search for wealth these days will be frustrating. Stock markets are way overvalued. Consider the following two graphics. They demonstrate the percent rank of three common stock valuation metrics, computed since July 1997 (first graph) or December 2000 (second graph).

The first graph indicates that American stocks are currently more expensive, with respect to earnings, than 92% of the months since July 1997. The second graph indicates that American stocks are at a record high with respect to book value and sales, in the period since December 2000.

The case would be even more alarming if we introduced earlier data, from before 1997. However, using statistical techniques, I have established that there was a fundamental shift in the American stock market around mid-1997, in which investors became willing to pay higher prices for a dollar of earnings than they had previously, thanks most likely to online trading.

Any reversion to the mean must come about either through a significant stock market correction, even a bear market; or through a massive increase in corporate earnings thanks to a more powerful consumer. Of course, I hope the second scenario will prevail. This will put president-elect Trump’s economic policies to the test.

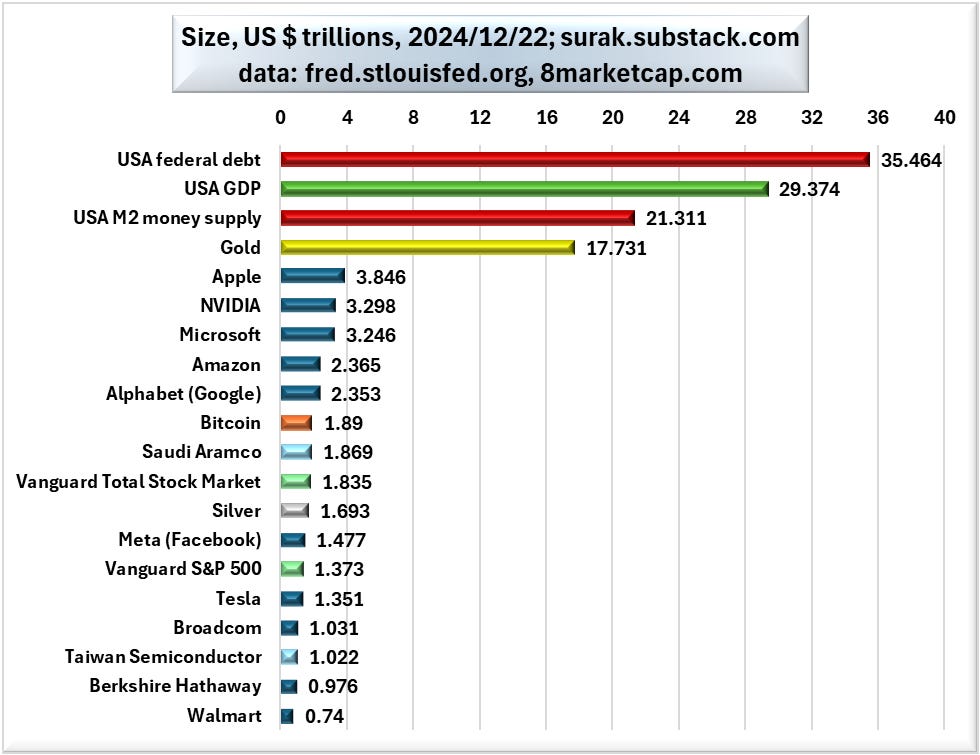

Are better investment opportunities outside the American stock market? For some answers, I got information from https://8marketcap.com/ and https://fred.stlouisfed.org/categories. From the former, I identified the 17 largest investable assets in the world, including all assets worth more than $700 billion. From the latter, I found three macroeconomic aggregates concerning the American economy. They are shown below.

It is amusing to read Bitcoin fans dismiss criticism of the volatility of cryptocurrencies. They say that it isn’t the price of Bitcoin that is fluctuating; it is the price of everything else in the economy! We call that “the tail wagging the dog”. It is a bit presumptuous for an asset currently worth less than $2 trillion.

Bitcoin fans learned this rhetorical technique by listening to gold bugs, who have said a similar thing for centuries. Gold bugs are more believable, because their asset, at $17.7 trillion, is over nine times the size of Bitcoin, and more than four times the size of the world’s largest stock (Apple, at $3.8 trillion).

Even the world’s gold supply pales beside the size of the US economy ($29.4 trillion), however. And even the latter is dwarfed by the combination of the American money supply and government debt, whose sum ($56.8 trillion) is almost double the size of GDP. I have discussed this ratio before, and it is far worse today than its strongest value of about one-to-one.

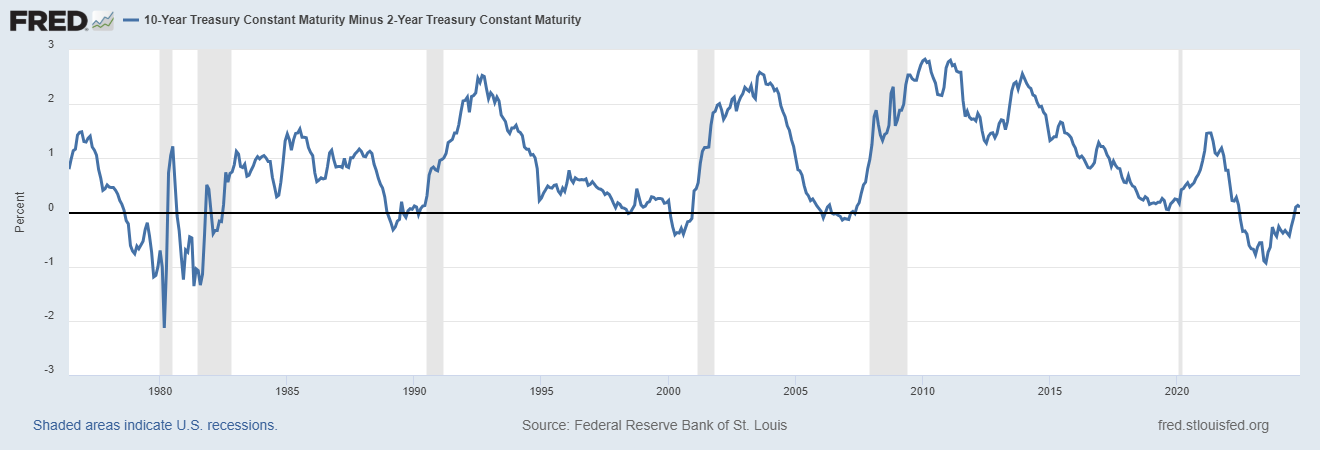

All of this should serve as a reminder that while economics and finance are not the same, monetary and fiscal policy will constrain financial growth prospects. I have observed enough to concede the truth of the maxim, “You cannot fight the Fed.” Whether they act wisely or foolishly, the Fed’s decisions and the bond market in general set limits on how other investments perform. We still have not paid the price of recession for the recent yield curve inversion, which was the steepest since 1981; see the graph below.

Stock investors should consider seriously recent gyrations in the stock market. Personally, I am not optimistic about any of the major asset classes, and suspect that the safest course involves taking income from high-yield bonds. This could change dramatically if Elon Musk and Vivek Ramaswamy are able to eliminate hundreds of federal agencies, as they hope, thereby reducing and hopefully eliminating the federal deficit; and if mass deportation of illegal aliens gives more bargaining power to American workers.

Disclaimer: I am not a financial advisor. I am merely sharing information I have found online. Please speak to a professional financial advisor for your investing decisions.

Next time, we will move from wealth to health, discussing cholesterol.

Frightening that you have to go down to 14th before you arrive at something that actually produces a tangible product.