I have come across two powerful videos in the past couple of weeks, linked on certain blogs. In these videos, young men express their incredible frustration with the state of the economy. They are not seeing wages keep up with the cost of living. The prices they describe sound exorbitant.

Language warning: these videos contain a lot of foul language.

https://www.tiktok.com/@itstrevorabney/video/7322905582938180906

https://www.tiktok.com/@nicsmnrs/video/7353262299437763886

They are both working. They are not craving luxury items. The basic necessities seem out of reach to them.

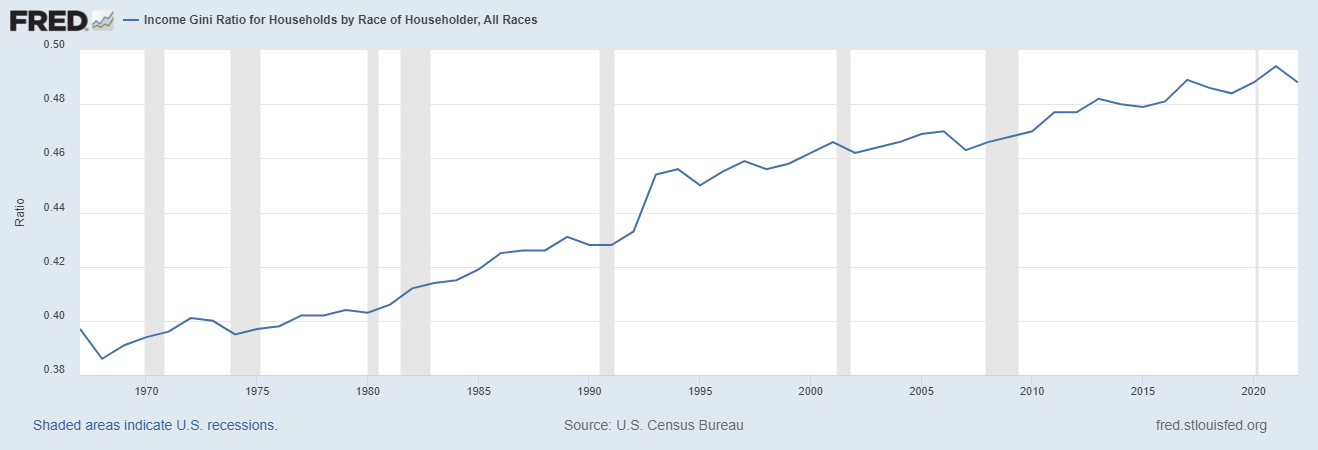

Part of the problem is time of life. That is, one starts out with almost no wealth, and accumulates it gradually over the years. However, there has been a nationwide gradual increase in income inequality, as shown in the following graph, which runs from 1967 to 2022.

The Gini index computes the degree of income inequality. The value is zero when all incomes are equal. The value is one when one person receives all the nation’s income.

The lowest point on the graph was in 1968, at 0.386. Most of Europe today is below that point, The highest point on the graph was in 2021, at 0.494. Only 14 countries have a higher Gini index, and they are in sub-Saharan Africa or Latin America. That is the amount of change that can bring a country to the brink of political revolution, if not the real thing.

What are you seeing with your own children and grandchildren? Are they spending too much on luxuries? Are they struggling with the basic necessities?

I think the concerns in these videos should be addressed. They believe they cannot achieve what their parents and grandparents achieved. Without a snide dismissal, what would you tell them?

My daughters are all struggling with the basics these days, particularly those with young children and teenagers. The price of the basics has escalated since the lockdowns but more importantly since the Ukraine war. Both created by government.

Our Money is Debt

What ails the youth as they struggle to survive today? Intuitively, one would think that money, like that which it buys, would be an asset. But that second-order derivation is from a bygone, simpler time and these are not them (see “The Great Taking” download https://img1.wsimg.com/blobby/go/1ee786fb-3c78-4903-9701-d614892d09d6/taking-ebook-c044a5e.pdf ). Now, we function on the other side of the Mobius strip, where Federal Reserve “Notes” are the coin of the realm and fractional reserve banking allows for financialization of debt (that is, creating debt and calling it money). Since money is now created (and not earned through production of assets) it can and is now being abused by too much money chasing too few necessities of life. This is debasement of the currency and functions as a secret tax on wage earners. Our government is akin to a teenager living in their parent’s basement, with no money of their own, but having secured the credit card of Mom and Pop, spending for today’s wants and kicking the payment down the road to our children's children’s children. This only proves Lord Acton’s dictum that we mere mortals cannot handle god-like power without spending everything on drugs and chicks, while hoping for the best. But there is a corollary to hoping for the best, and that is to expect the worst, which is what our parent’s grandchildren are now confronting. The problem is wholly created by a ruthless parasitic entity. We have tried talking therapy and even drugs to poison the behemoth . All that is left to try now is surgery.