Financial thoughts as we go from 2025 to 2026

Beware the bubble

In my last financial post, I noted the shape of the graph of bubbles in the price of silver. They tend to be very sharp narrow spikes, that rise quickly and fall equally quickly. Guess what happened this past week? The price of silver collapsed about 13%.

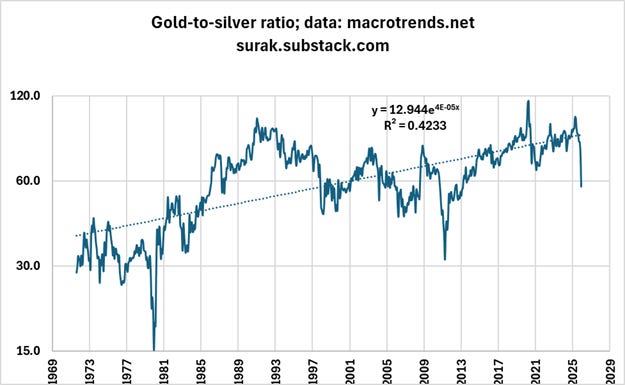

Let us look at the gold to silver ratio.

This ratio is far below the exponential trend. That means that silver is either way overpriced, or gold is underpriced. In any case, the “experts” who are forecasting silver at $300/ounce are way off base.

On American stocks:

the Shiller cyclically adjusted price-earnings ratio is over 40, the highest since August 2000 during the tech bubble.

Price-to-book value is 5.55, the highest in the history of this time series going back to December 1999.

Price-to-sales value is 3.42, the highest in the history of this time series going back to December 2000.

The Buffett indicator (US stock market capitalization divided by US GDP) stood at a record 230% on September 30, 77% higher, and 2.4 standard deviations higher, compared to the historical trend.

All of this implies the US stock market is at obvious risk for a correction. So why doesn’t it correct? Presumably due to optimism about earnings. But recall that all calculations are based on market capitalization weighted indexes like the S&P 500. NVIDIA and Apple each constitute over 7% of that index; Microsoft constitutes over 6%; Google over 5%; Amazon nearly 4%. Those five companies are over 30% of the S&P 500. The US stock market is highly concentrated at this time.

Why are some analysts bullish about the US stock market for 2026? They believe that business now has greater certainty regarding tariff policy. Costs for housing, gasoline, and drugs are beginning to decline modestly, which should free up some consumer spending.

Where should an equity investor look? I generally avoid individual stocks at my age, and prefer ETFs, to somewhat reduce concentration risk. There are many useful screens one can employ with ETFs. Here are two examples; there are many more.

The Sharpe ratio is the ratio of average return (over a risk-free investment) to the standard deviation of return. It rewards funds with a good return and little volatility. High values are better.

The PEG ratio is usually applied to stocks, but can be calculated for ETFs as well. It is the ratio of the price-earnings ratio to the growth rate for earnings. Low positive values are better.

Instead of computing a screen based on two criteria, I experimented by boiling this down to one simple ratio: the Sharpe ratio divided by the PEG ratio. High values are better.

This past summer, I ran this screen on the 500 largest ETFs (based on assets under management), and the winner was ARGT, an index fund for the Argentine stock market. I put my money where my mouth was and purchased it. This investment has increased 13% since then, although there has been more volatility than I would like.

When I re-ran the calculation this afternoon, ARGT still came out on top. Be warned that Morningstar considers this a 1-star investment out of 5 stars, possibly due to its volatility.

Out of curiosity, I adjusted my formula to reward stability and penalize volatility more than the original formula. ARGT was still the best, but an Italian index fund approached more closely for second place.

Remember, I am not certified as a financial advisor. I am simply sharing data and my calculations. Check with a professional before investing.

With the dollar being so anemic and the bond market not creating excitement, the uber wealthy are depending on the stock market to create wealth. I moved about 20% out of the stock markets during COVID. Some sits around as "cash" and some was traded for gold. So, I've lost a little appreciation, but I'm still doing fairly well (especially since gold has doubled in 3 year). Still, I'm at the age where they say it's unwise to have a high percentage in stocks, so, I'll be selling instead of buying. I think both gold and silver will keep going up as the dollar goes down.

Have you invested using your Sharpe ratio divided by PEG ratio? I have some ETFs and some mutual index funds.

Something else to research, I have not even finished the last one on migration.

I feel like I am cramming for exams!